The highest personal income tax applicable for 2016 is 28. Jeyapalan Kasipillai A Guide to Advanced Malaysian Taxation.

Accamuneeb I Will Do Bookkeeping In Quickbooks For 15 On Fiverr Com Quickbooks Quickbooks Online Best Accounting Software

Income tax -- Law and Legislation -- Malaysia Taxation -- Law and legislation -- Malaysia Income tax --.

. The Peninsula Malaysia region bordering Thailand ie. Income derived in Malaysia by a non-resident public entertainer is subject to a final withholding tax at a rate of 15. 9789834728779 Based on 0 reviews.

Get updates on the current investment climate and find out the latest on withholding taxes indirect taxes and more in this Guide. Download a copy of the form and fill in your details. Choong Kwai Fatt Malaysian Taxation Principles and Practice Malaysia.

Todays issues Insights Industries Services About us Careers. That said income of any person other than a resident company carrying on the business of banking insurance or sea or air transport derived from. Failure to do so can result in a 10 increment of the payable tax or a disciplinary fee.

Chen Chuan Goh Publisher. 20212022 Malaysian Tax Booklet. West Malaysia and the Malaysia Borneo region bordering Indonesia and Brunei ie.

Any individual present in Malaysia for at least 182 days in a calendar year. ER - Kasipillai J. The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Chinese summary of investment and tax information prepared and developed by Deloitte Malaysia Chinese Services Group.

A GUIDE TO ADVANCED MALAYSIAN TAXATION provides an in-depth analysis of the legal technical and administrative aspects of Malaysian taxation. PDF Mobi Category. This book will prove invaluable for income tax practitioners accountants business.

Do foreigners or expatriates who are working and earning income in Malaysia need to pay income tax. Personal Income Tax. AU - Kasipillai Jeyapalan.

Get updates on the current investment climate and find out the latest on withholding taxes indirect taxes and more in this Guide. A quick reference guide outlining Malaysian tax and other business information. Accelerating ESG integration in Malaysian banks.

BT - A Guide to Malaysian Taxation. Administrative and Technical Aspects Malaysia. Malaysia Master Tax Guide 39th Edition is a practical accurate and reliable presentation of the structure features and ambit of Malaysian income tax law.

Income tax Languages. How Does Monthly Tax Deduction Work In Malaysia. CY - Selangor Malaysia.

Your Instructor Song Liew Services We provide various company secretarial business process outsource tax and consulting services to our clients. From 2016 personal Income tax rates applicable to taxable income are as follows. Skip to content Skip to footer.

Veerinderjeet Singh Malaysian Taxation. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021. Malaysia is divided into 13 states and three federal territories with Kuala Lumpur as.

Any foreigner who has been working in Malaysia for more than 182 days considered as residents are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian nationals. It is applicable to all tax residents. This is the income tax guide for the year of assessment 2020.

Tax Offences And Penalties In Malaysia. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. To complete a tax return expats need to fill out a Yearly Remuneration Statement EA.

20212022 Malaysian Tax Booklet. The foundation of the work is legislation extracted from the Income Tax Act 1967. The coupon code you entered is expired or invalid but the course is still available.

Everyman S Guide To Understanding The Malaysian Income Tax A Guide To Malaysian Taxation by Chen Chuan Goh Everyman S Guide To Understanding The Malaysian Income Tax Book available in PDF EPUB. - Write a review. OBJECTIVES OF TAX As a source of national income Source of tax revenue is use to administer the country and to.

It provides clear explanation of how the law is applied to individuals partnerships limited liability partnerships corporations and other. A BIP Guide to Malaysian Taxation Everything you need to know about Malaysian Taxation off original price. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

It covers all the latest amendments including those arising from the Budget 2013 and recently issued public rulings. Malaysia Master Tax Guide 2022 39th Edition. PB - McGraw-Hill Education.

T1 - A Guide to Malaysian Taxation. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. A GUIDE TO MALAYSIAN TAXATION is an all-inclusive book covering every aspect of basic taxation.

It explains the core tax concepts and principles. Malaysia located in Southeast Asia is separated by the South China Sea into two non-contiguous regions. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors employees.

Guide To Using LHDN e-Filing To File Your Income Tax. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. The new legislation was called the Income Tax Act 1967.

This book will prove invaluable for the. It covers all the latest amendments including those arising from the Budget 2013 and recently issued exemption orders. In 1967 the income tax laws were consolidated and revised to create a unified federal income tax which was anacted by the the Parliament and became effective throughout Malaysia.

The tax year in Malaysia runs from January 1st to December 31st. All tax residents subject to taxation need to file a tax return before April 30th the following year. A Guide to Malaysian Taxation Fifth Edition ISBN.

Click on Permohonan or Application depending on your chosen language. All income accrued in derived from or remitted to Malaysia is liable to tax. Go back to the previous page and click on Next.

The Guide to Taxation and Investment in Malaysia 2019 is a bilingual English-Korean summary of investment and tax information prepared and developed by Deloitte Malaysia Korean Services Group. Malaysian Master Tax Guide. Doing business in Malaysia 2021.

Malaysia has a progressive scheme for personal income tax. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021.

How To Pay Your Income Tax In Malaysia. This publication provides a concise yet comprehensive guidance on the essentials of Malaysian taxation to enable a working understanding of the law and practice of taxation in Malaysia. Xviii 707 pages.

Malaysian Tax Issues For Expats Activpayroll

Tax Guide For Expats In Malaysia Expatgo

Crowe Perspectives Badges Of Trade Crowe Malaysia Plt

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

A Guide To Malaysian Taxation Jeyapalan Kasipillai 9789675771675 Books

A Guide To Malaysian Taxation Jeyapalan Kasipillai 9789675771675 Books

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

Accounting Software To Boost Your Business Growth In 2022

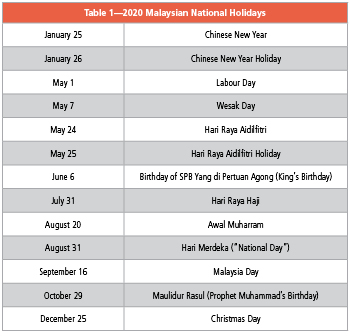

2020 2021 Malaysian Tax Booklet

How Does Tax Residency Status Change In Malaysia

Accounting Software To Boost Your Business Growth In 2022

Contoh Resume Student Uitm Resume Template Resume Job Resume Template

Amazon Guide To Advanced Malaysian Taxation Jeyapalan Kasipillai 9789675771682 Books

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Tax Implications On Digital Services Crowe Malaysia Plt

What You Need To Know About Malaysias Tax System

Service Tax On Cross Border Services The Onus On Malaysian Customer Or Foreign Service Provider